It was the remodel of a Starbucks that sent me hurtling into The Bubble this morning Had they not decided to ruin my favorite Starbucks by removing all the comfortable seating and replacing it with bent-wood chairs and tables, I might never have had the chance to visit The Bubble this morning.

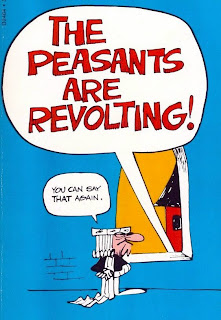

Now you know The Bubble. It's that strange world of semi-lucid fictional reality generated by the various conservative reality-distortion systems. Systems like Townhall.com, Fox News, The Daily Caller, The National Review and the various corporate funded "think" tanks: Cato, Heritage and the American Enterprise Institute. Their job is to ensure the uniformity of thought among The Bubble's inhabitants. There can be no dissension among the ranks of The Bubble faithful. Apostasy is not tolerated. Ever.

Normally, I hang out with a a mixed group of folks at that Brookfield Starbucks, some liberals some moderates and a few conservatives. But with this awful remodel, the group has been fragmenting. So with my favorite Starbucks effectively off-line, I was forced to relocate west from Brookfield (where the Starbucks is conveniently located adjacent to an Einstein's Bagels) to the Starbucks on Highway 18 near Walgreens. They have not (yet) been subjected to a remodel so their old, broken-in chairs are still as comfortable as ever.

I picked up my Venti Pike's Place and performed the various ritual ablutions on it to make it sweet and creamy and looked for a seat. I spotted an open chair next to a side table. The chair adjacent was occupied by a yellow shirted gentleman reading the New York Times and chatting with another guy.

So I sat down and proceeded to fire up my iPad and get to reading my book. I listened in on their conversation (a polite way to say "eavesdropped") and when it turned to food, I chimed in. We talked about seafood and steaks and such. The conversation turned to real estate and I mentioned that I was selling my house and that we were buying a new one in Madison. That's when yellow shirt said that he didn't think real estate was a good investment. I agreed and said that as long as we had the level of income disparity we have now, fewer people would be able to buy houses and the bubble would take a lot longer to deflate. Much of the construction boom we see now is in multi-family apartment-style buildings and not single-family homes.

You would have thought that I had taken a big crap in his cappuccino because that just sent him spiraling down into a rather incoherent rant about how it was Jimmy Carter's fault that all this happened because in 1977 Congress passed the Community Reinvestment Act. This was a problem because it encouraged people who should own homes to own homes. Now, in a way, I agree with him. But I disagree that you can trace the whole mortgage crisis back to 1977 since the original act never led directly to the bubble. It was the various changes in the law over the years that caused the bubble to inflate. This point caused much wailing an gnashing of teeth among the three of them because of FANNIE and FREDDIE... or something.

So this went on, back and forth and spanned a wide range of subjects, all of which proceeded from assumption derived from The Bubble. Here's a brief list of things I learned from my brief sojourn into The Bubble.

- Because we didn't see a massive recovery from the stimulus, it failed. Never mind that most reputable economists (i.e. those who do not earn their living reinforcing the prejudices of The Bubble) argued that the stimulus worked in that it prevented a further slide into depression but that it was too small to do anything more than putting on the brakes.

- Public Spending always crowds out Private Spending. When I tried to point out that this was only true in times of full employment (like in the late Clinton years), they said I was making things up. I asked them to explain to me the mechanism of crowding out in a time of 10% unemployment assuming the natural rate was 4%. How is the public sector crowding out the private sector when 6% of the people can't find work. There was much wailing an gnashing of teeth but no real answers.

- Only business owners are capable of talking about economics. I was asked if I ever owned a business because what did I know if I never owned a business. I responded that my sister-in-law had uterine cancer but she went to a male doctor who never had uterine cancer. Did that make him ill-equipped to diagnose and treat her? Many Major League umpires have never played baseball, does that make them unsuited to be umpires? Basically, they're lapping up the frothy mixture of Obama is a Socialist Community Organizer combined with the Romney is a business guy who can create jobs.

- Food stamps are always bad. When I pointed out that there were plenty of examples of government programs that can help drive demand in a depressed economy, they were incredulous. How do food stamps contribute to the GDP they asked? I explained the fiscal multiplier effect. They were incensed! It's all hokum. Mumbo-jumbo! What they cannot (or will not) recognize is the veracity of the demand-driven economic model. By stimulating demand, you create a ripple effect through the whole economy. They refused to believe it. They disbelieve the money multiplier effect as well.

- FDR caused the Great Depression to be prolonged. Apparently one of them read Amity Shlaes widely debunked The Forgotten Man: A New History of The Great Depression and believed it. Most reputable (i.e. non-Bubble) economists and historians find it amusingly inadequate and poorly researched. Krugman, among others, have called it revisionist history of the worst sort.

- The debt will kill us! The bond vigilantes are coming! The treasury is keeping bond rates artificially low. They're going to explode any day now. I explained how bond rates were a market-driven function. Bond rates are set at auction and, in fact, yield rates have never been lower. The high demand for government bonds produces low interest rates. It's the market. No, no, no they said. It was the Fed doing it. I explained that the Fed sets the overnight rate, not the interest rates on bonds. No, they replied, the overnight rate is tied to the bond rate… Or not.

In 1929, the U.S. Treasury shifted from the fixed-price subscription system to a system of auctioning where 'Treasury Bills' would be sold to the highest bidder. Securities were then issued on a pro rata system where securities would be allocated to the highest bidder until their demand was full. If more treasurys were supplied by the government, they would then be allocated to the next highest bidder. This system allowed the market to set the price rather than the government. On December 10, 1929, the Treasury issued its first auction. The result was the issuing of $224 million three-month bills. The highest bid was at 99.310 with the lowest bid accepted at 99.152.

I could go on, but what's the point? Fortunately, the subject of healthcare came up only briefly when I tried to explain how the government's Medicare program works more efficiently than the private sector Medicare Advantage. At one point, one of them got up and said that it was idiots like me who didn't know what the hell I was talking about and then he stormed out, his prejudices and his bubble intact.

I can't wait until next Sunday!